wealthfront vs betterment tax loss harvesting

Ad Advice Powered By Relationships Not Commissions From A Financial Planner You Can Trust. Retirement Planning comes down to preference while Betterments Cash Account.

Betterment Review 2022 The Best Robo Advisor One Shot Finance

Both Betterment and Wealthfront enable tax-advantaged investing through tax-loss harvesting.

. Tax-loss harvesting means selling losers to take a tax loss that can offset gains. Unlike Betterment Wealthfront uses stock-level tax-loss harvesting to invest directly in the SP 500 and not just ETFs. The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and dispositions in a clients or clients spouses accounts outside of Wealthfront Advisers and type of investments eg taxable or nontaxable or holding period eg short- term or long.

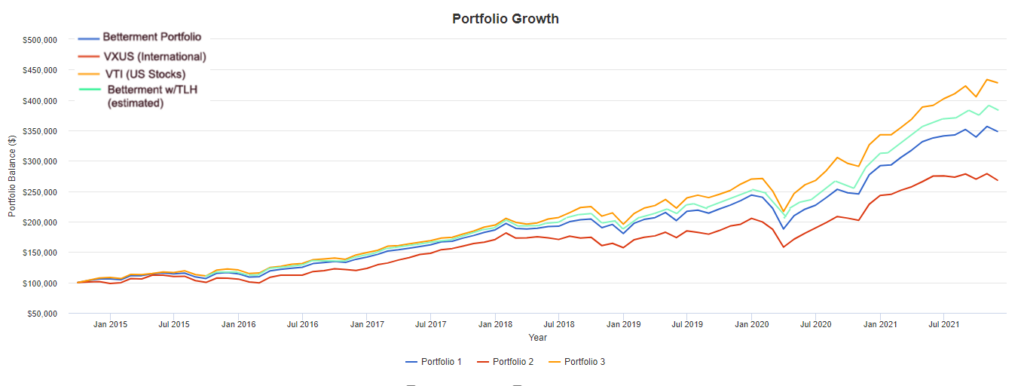

Wealthfronts ability to customize down to the ETF level is unnecessary for many investors who appreciate the ease and optimization of robo-advised portfolios. Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees. The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and dispositions in a clients or clients spouses accounts outside of Wealthfront Advisers and type of investments eg taxable or nontaxable or holding period eg short- term or long-termTax loss.

If I look at the value prop for Betterment or Wealthfront it seems that I can achieve all of the benefits of their service through Vanguard using Admiral Total Market funds except for tax harvesting. Regarding Tax Efficiency both offer access to advanced Tax-Loss Harvesting. TLH in Betterment vs Wealthfront.

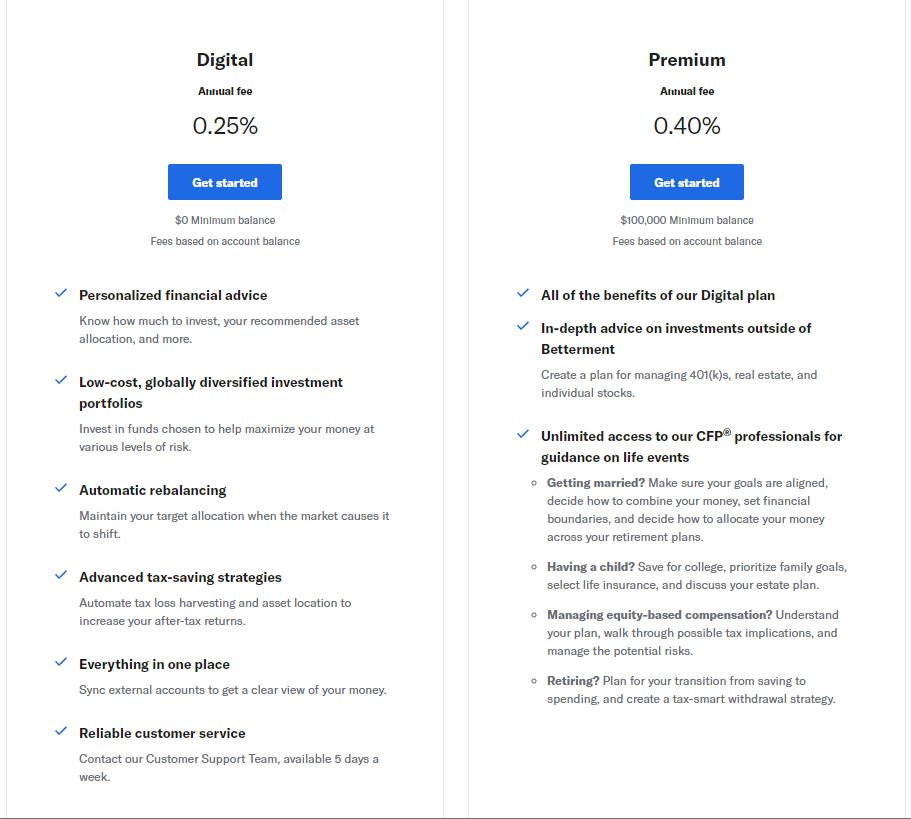

One low fee of 025 on all accounts up to 2 million. They claim this generates more savings over other robo-advisors who do less frequent checks. Best of all if you sell more losses than gains you can carry those forward to the following tax year.

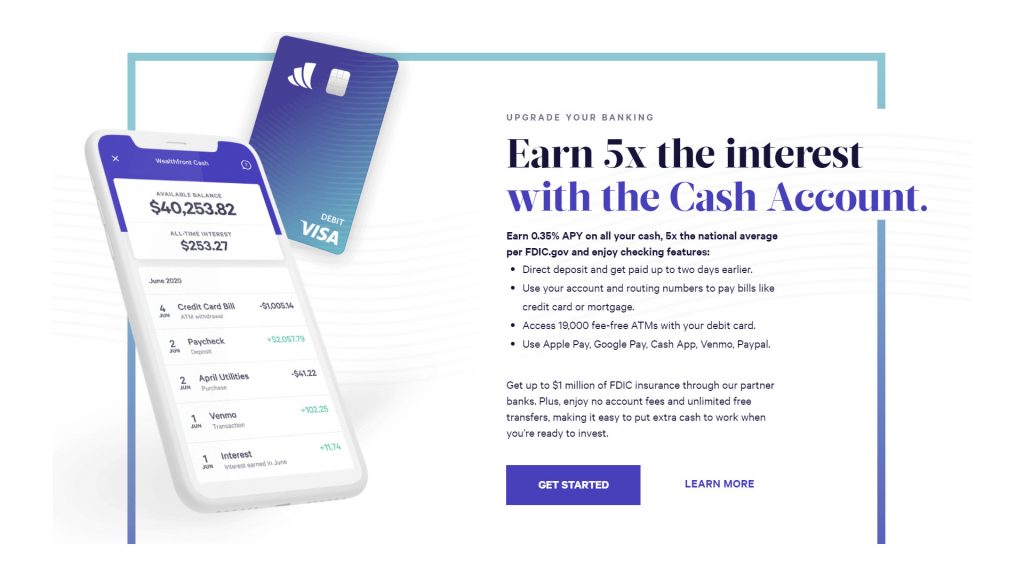

I have around 11000 in both Betterment and Wealthfront. Ad Upgrade Your Banking and Grow Your Long-Term Wealth. Wealthfront also offers tax-loss harvesting.

Fee drops to 015 on accounts above 2 million. Wealthfront 1 Designed to manage your finances with the help of financial experts. This is free for all Wealthfront clients who invest in the risk parity portfolios IRAs and college savings accounts.

Betterments Investment Portfolios Beat Wealthfront. Wealthfront stands out in the robo-advising world because they offer daily tax-loss harvesting on accounts. Human assisted investment advice.

Global diversification portfolio and tax optimization for all users. From Innovative Technology To Time-Tested Investment Philosophy We Have You Covered. Wealthfront offers a Smart Beta option on account balances of 500000 or more.

This might be a distinct advantage since human oversight into the tax-loss harvesting process can. Customer support includes live chat. Grow Your Long-Term Wealth.

By adjusting the weight of your holding to better optimize. Instead of individual stocks Betterment only does tax-loss harvesting for ETFs. It overweighs exposure to certain securities like real estate investment trusts while also offering tax-loss harvesting.

Tax-loss harvesting increases your return but it doesnt. The strategy configures costs value and diversification in a different way than Betterments core portfolio. Betterment and Wealthfront pros Betterment.

Not many US robo-advisors have such an offer. Betterment and Wealthfront both use daily tax-loss harvesting to try to maximize your gains. Both companies offer significant tax strategy programs or tax-loss harvesting to every investor.

Stock level tax-loss harvesting direct indexing can be selected. Designed to manage your finances with a software-only approach. If you have over 500k in Wealthfront they also offer stock level Tax-Loss harvesting which can increase harvesting opportunities.

If you have the cash Wealthfront has a definite edge as the only major. Wealthfront Fees and Plans Betterment. Tax loss harvesting is an advanced investment strategy that Wealthfront and Betterment have both brought to consumers at no extra cost.

Wealthfront also offers tax-loss harvesting via direct indexing and automated portfolio rebalancing. They both offer tax loss harvesting. Its also a significant differentiator in the Betterment vs.

Betterment vs Wealthfront Tax-loss Harvesting. Wealthfront does have a distinct advantage over Betterment because it offers the PassivePlus option for those who qualify. Tax loss harvesting at its simplest level is the practice of selling an asset that has realized a loss and reinvesting that money back into the market.

The robo-adviser says it will automatically pay bills and invest the rest in the most appropriate accounts How To Turn Off Rtx Light 32 APY at the time that this story was written Save at Wealthfront with coupons. Risk Parity Fund is recommended to users with larger accounts introducing a conflict of interest. Banking And Investing In One Place.

Betterment provides tax loss harvesting at the index fund level but Wealthfront delivers more for those with more than 500K invested. All In One App. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

Its like regular tax-loss harvesting but instead of investing in only ETFs or index funds it invests in individual stocks in the SP 500. Many robo-advisors dont offer tax-loss harvesting at all or offer it only if you meet a specific investment minimum. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Now that they have Tax loss harvesting feature in both for everyone I need to decide which to move all my money into or else I risk wash sale with TLH in both - wealth front manages freely unto 20000 for me and I need to pay 25 in betterment. By providing tax loss harvesting at the stock level. Vanguard offers tax-loss harvesting but only on a case-by-case basis.

This guide may help you avoid regret from making certain financial decisions. Their methods for tax harvesting are similar involving selling assets that have generated losses and then buying related ones of similar exposure to replace them. Daily tax-loss harvesting free for all taxable accounts.

Betterment at a glance. The stock-level tax-loss harvesting and risk parity strategies require a minimum account balance of 100000 PFI SmartAssetLike Betterment Wealthfront also offers traditional Roth and SEP IRAs. Tax-loss harvesting on all taxable accounts.

Retirement Planning and Cash Accounts with both services are very similar. Wealthfronts daily tax-loss harvesting purports to give investors greater benefits than less frequent tax-loss harvesting. You can open an account with no money at all.

Betterment Vs Wealthfront Vs M1 Finance Comparison

The Betterment Experiment Results Mr Money Mustache

Betterment Vs Wealthfront Vs Vanguard Comparison Best Robo Advisor Reviews Advisoryhq

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Vs Acorns 2022 Best Platform

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks Investinganswers

Betterment Vs Wealthfront Which Robo Advisor Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Which Is Better Thestreet

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Vs Wealthfront Which Is Better Mustard Seed Money

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

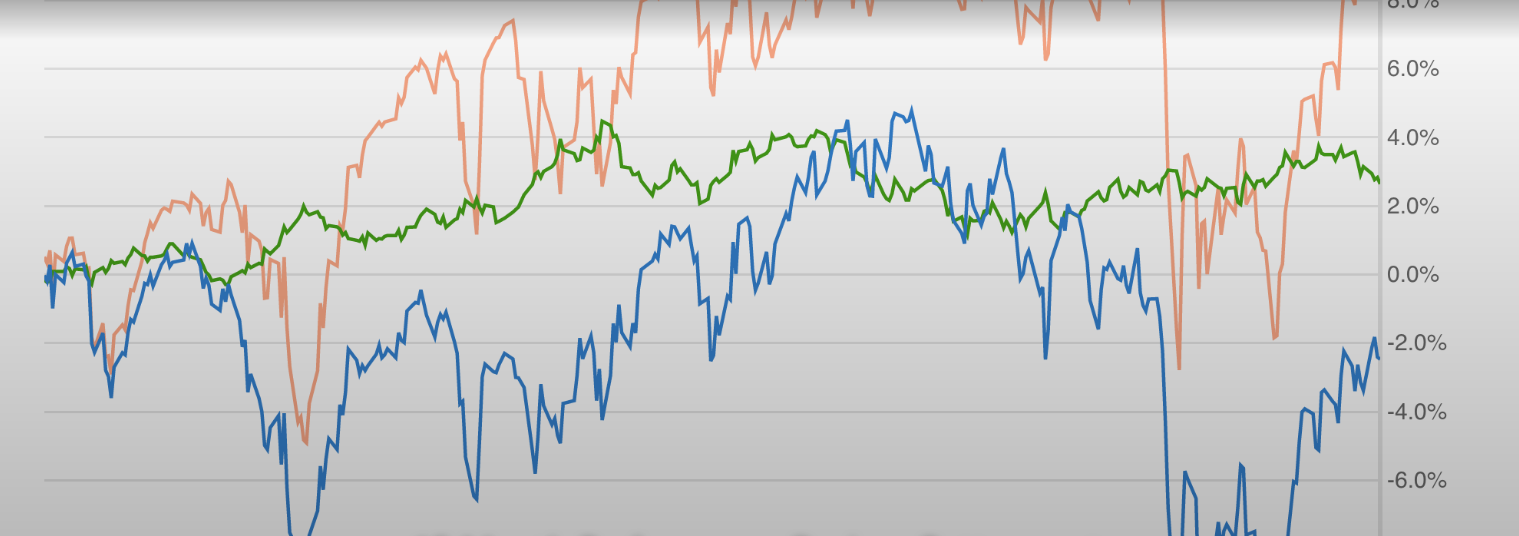

15 Month Performance Review Betterment Vs Wealthfront Vs S P500 Vs Other Options